The global drywall plastering market is currently undergoing a period of dynamic transformation, characterized by robust growth, significant regional shifts, and a rapidly evolving landscape influenced by technological advancements and an increasing focus on sustainable practices. With worldwide drywall consumption reaching an impressive 11.1 billion square meters and a market value of approximately $23.3 billion in 2022, the industry has demonstrated substantial expansion, reflecting a notable global adoption trend since 2007. This comprehensive report delves into the intricate details of this market, providing an in-depth analysis of its current state, projecting future growth trajectories, and dissecting the key factors that are shaping its evolution.

As we navigate towards 2027, the market is poised for continued, albeit moderate, growth, with global demand expected to expand by approximately 1.8% annually, ultimately reaching 12.2 billion square meters. This anticipated steady increase is underpinned by a confluence of factors, including the resurgence of key regional markets, particularly China’s outsized influence, and a strategic shift towards commercial construction as the primary growth engine. Furthermore, the industry is grappling with persistent challenges, such as labor shortages, which are simultaneously catalyzing innovation in automation and robotics, while the critical imperative of environmental sustainability is driving significant shifts towards eco-friendly products and recycling initiatives across the supply chain.

Key Takeaways:

- Global drywall consumption reached 11.1 billion sq. meters ($23.3 billion) in 2022, projected to hit 12.2 billion sq. meters by 2027.

- China is the largest market, expected to drive 44% of global demand gains through 2027, propelled by commercial construction.

- North America remains a major consumer (U.S. to sell ~28 billion sq. ft. in 2024), but growth is leveling off compared to dynamic Asia-Pacific.

- Commercial construction (offices, hotels) is the dominant growth segment, forecast to reach 6.8 billion sq. meters by 2027, largely driven by urbanization and public infrastructure.

- Market value may slightly decrease to $22.7 billion by 2027 due to price normalization post-pandemic peaks, despite volume growth.

- Labor shortages (~20% gap) are spurring automation, with robotics boosting productivity 3-5x in some tasks.

- Sustainability is a critical focus, with only 2% of U.S. drywall scrap recycled and a 22% uptick in ‘eco-drywall’ product launches in two years.

1. Executive Summary

The global drywall market, a critical component of modern construction, is experiencing a period of robust and steady growth, underpinned by evolving regional demands, technological advancements, and an increasing focus on sustainability. In 2022, worldwide drywall consumption reached an impressive 11.1 billion square meters, translating to a market value of approximately $23.3 billion at the manufacturer level1. This represents a substantial increase from approximately 7.8 billion square meters in 20072, indicating a significant global adoption trend. Projections indicate that this growth trajectory will continue moderately, with global demand expected to expand by approximately 1.8% annually, reaching 12.2 billion square meters by 20273. This executive summary provides a comprehensive overview of the current state of the global drywall market, detailing key drivers, regional dynamics, emerging trends, and the challenges faced by the industry.

The market’s expansion is not uniform, with certain regions emerging as primary growth engines. Notably, China has solidified its position as the world’s largest drywall market, and despite a slowdown in 2022 due to COVID-19 lockdowns and real estate curbs, it is projected to drive approximately 44% of global drywall demand gains through 20274. This resurgence is largely fueled by a rapid shift from traditional plaster to modern drywall methods, particularly in commercial construction projects5. Meanwhile, North America, historically a dominant player, continues to be a major market, with the United States anticipating around 28 billion square feet of wallboard sales in 20246 and consuming approximately 45 million tons of gypsum in 20237, although its growth is now leveling off compared to the more dynamic Asia-Pacific region8.

A significant trend influencing the market is the increasing dominance of commercial construction. Non-residential buildings, including offices, hotels, and institutional facilities, are expected to account for 6.8 billion square meters of drywall use by 2027, growing at an annual rate of approximately 3.4%9. This growth significantly outpaces the residential segment, which is projected to remain relatively flat at around 5.4 billion square meters10. This divergence highlights the impact of government investments in public infrastructure and rapid urbanization, particularly in Asia and Africa, where large-scale commercial projects are driving drywall adoption1112.

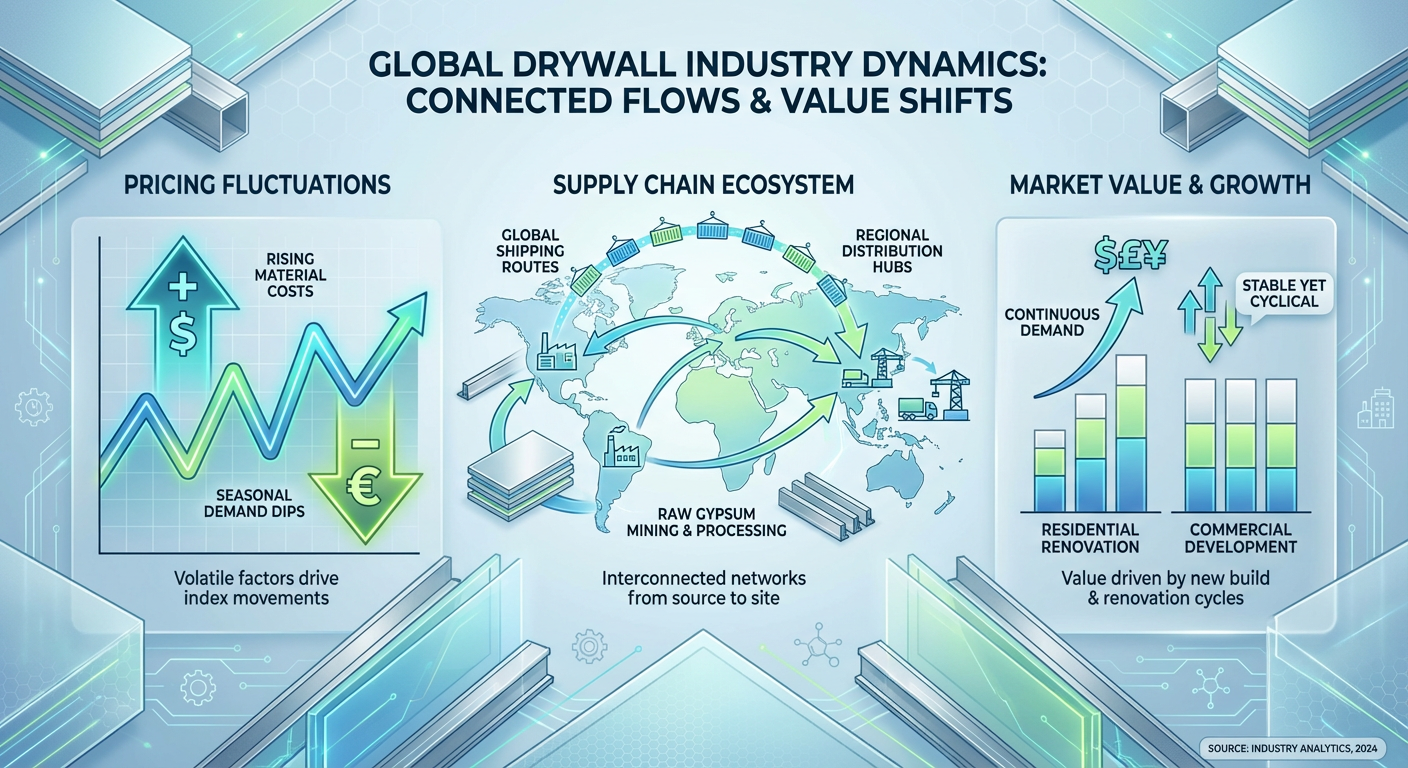

Market value and pricing have experienced considerable flux. The early 2020s saw substantial price inflation, with U.S. drywall prices surging for seven consecutive quarters, including an 8% jump in Q3 2022 alone, reaching record highs1314. This was attributed to supply chain disruptions, raw material hikes, and robust demand. However, as supply chains normalize and demand cools, prices are stabilizing. The global market value is paradoxically expected to slightly decrease to $22.7 billion by 2027 despite volume growth, due to the normalization of prices from their pandemic-era peaks15.

Other critical factors shaping the industry include persistent labor shortages, which are spurring innovation in robotics and automation, and a growing emphasis on sustainability. The shortfall of skilled drywall installers, estimated at a ~20% gap, is accelerating the adoption of robotic systems for tasks like heavy sheet lifting and sanding, which have shown to boost productivity by 3–5 times in some cases161718. Furthermore, the significant environmental impact of drywall, from gypsum mining to its contribution to 30–40% of global landfill waste19, is driving demand for recycling and “greener” solutions. Only about 2% of U.S. drywall scrap is currently recycled into new wallboard20, and its decomposition in landfills can release toxic hydrogen sulfide gas21, prompting stricter regulations and increased investment in recycling infrastructure by major manufacturers. A 22% uptick in “eco-drywall” product launches in the last two years underscores this growing trend22.

1.1 Global Drywall Market Size and Growth Projections

The global drywall market demonstrates a trajectory of consistent, albeit moderate, growth. In 2022, the worldwide consumption of drywall material reached 11.1 billion square meters, representing a substantial market value of approximately $23.3 billion at the manufacturer level. This data, provided by The Freedonia Group, highlights the industry’s significant scale and economic contribution1. This recent figure represents a considerable expansion from 2007, when global consumption stood at approximately 7.8 billion square meters2, illustrating a nearly 42% increase in volume over 15 years. This growth indicates a continued global shift towards more efficient and modern construction methods, with drywall steadily replacing traditional plastering techniques in an increasing number of countries.

Looking ahead, market forecasts project a sustained upward trend in demand. Global drywall demand is expected to grow at an average annual rate of approximately 1.8% through 2027, culminating in a projected total demand of 12.2 billion square meters3. This positive outlook by Freedonia (2024) is predicated on a broader recovery in the construction sector post-pandemic, coupled with the continued adoption of drywall in developing and emerging economies. While this growth rate is moderate, it reflects a mature product category that continues to find new applications and geographical penetration.

Interestingly, while volume is projected to increase, the market value is expected to experience a slight decline. Global market value is forecast to tick down slightly to $22.7 billion by 202715. This apparent paradox is largely attributed to the normalization of drywall prices. Following significant price surges during 2021–2022, driven by supply chain disruptions and raw material cost inflation, unit prices are expected to stabilize and ease. Essentially, the industry anticipates selling more square meters of drywall but at a more normalized price point per unit as supply chain issues are resolved15.

The intensity of drywall usage varies dramatically across different regions, reflecting diverse construction practices. North America, for instance, has historically shown a very high per capita usage compared to the global average23. While the overall growth is moderate, this regional nuance suggests that there remains significant untapped potential in markets where drywall adoption is still in its nascent stages.

1.2 Regional Dynamics and Leading Markets

The geographic landscape of the global drywall market has undergone substantial shifts, with a notable rebalancing of influence. Historically, North America dominated drywall consumption, accounting for almost half of global sales in 200724. However, the Asia-Pacific region has now emerged as the largest market, largely driven by the colossal demand from China.

China’s Pivotal Role: China has become the undisputed leader in the global drywall market, both in terms of consumption and production. After a challenging 2022, which saw a slump in demand due to stringent COVID-19 lockdowns and government-imposed restrictions on the real estate sector25, China is experiencing a significant rebound. Forecasts suggest that China will contribute an extraordinary 44% of global drywall demand gains through 20274. This accelerated growth is primarily fueled by a strategic shift in Chinese construction from traditional, often labor-intensive, plaster and concrete methods to modern drywall techniques, particularly within the commercial building sector (e.g., offices, public infrastructure)5. This underscores China’s outsized influence; its market dynamics can significantly sway global trends.

North American Consistency, Slower Growth: The United States remains the second-largest drywall market and a significant consumer. Following a robust post-pandemic revival, U.S. wallboard sales are expected to reach approximately 28 billion square feet in 20246. The consumption of gypsum, the primary raw material for drywall, also hit 45 million tons in 2023 in the U.S.7, reflecting a healthy domestic industry. However, North America’s growth is now maturing and leveling off, especially when compared to the rapid expansion seen in Asia-Pacific markets8. While drywall is standard in North American homes, with an estimated per capita usage of ~11 square meters annually in the U.S.26, signifying high penetration, other regions are catching up rapidly.

Emerging Markets as Future Growth Engines: The long-term growth narrative increasingly centers on emerging economies in South Asia, Southeast Asia, Africa, and parts of Latin America. These regions, characterized by vast populations, rising urbanization, and increasing incomes, possess immense construction needs but currently exhibit lower drywall adoption rates27. As these markets evolve, transitioning from traditional building materials to more efficient and standardized solutions, drywall demand is anticipated to surge. This is particularly true for non-residential construction, where multinational builders often introduce drywall as the preferred method for its speed and flexibility28. While residential adoption might be slower due to cultural preferences and cost considerations, the overall trajectory points towards a gradual global convergence in drywall usage, with these regions progressively increasing their per capita consumption.

The manufacturing base for drywall is also highly concentrated. In 2022, just eight countries—China, the US, Japan, South Korea, Russia, Germany, Canada, and the UK—collectively accounted for over 70% of global drywall output29. China and the United States alone represent a substantial share of this production, with China’s output being roughly one-third of the global volume30. This concentration means global supply chains and market stability are significantly influenced by economic and construction cycles within these key regions.

| Metric | 2022 (Actual) | 2027 (Projected) | CAGR (2022-2027) |

|---|---|---|---|

| Global Consumption (Volume) | 11.1 billion m²1 | 12.2 billion m²3 | ~1.8%3 |

| Global Market Value | $23.3 billion1 | $22.7 billion15 | ~-0.5% (value decline due to price normalization) |

| China’s Contribution to Global Gains | N/A | 44% of global volume gains4 | Significant |

| US Wallboard Sales (Volume) | ~2.6 billion m² (28 billion sq ft)6 | Leveling off (post-recovery) | Moderate |

| Non-Residential Drywall Use | ~55% of total (approx. 6.1 billion m²) | 6.8 billion m²9 | ~3.4%9 |

| Residential Drywall Use | ~45% of total (approx. 5.0 billion m²) | ~5.4 billion m²10 | Flat10 |

1.3 Market Drivers: Commercial Construction and Urbanization

The contemporary global drywall market is predominantly driven by two powerful forces: the accelerating demand from commercial construction and the relentless pace of urbanization, particularly in emerging economies. These factors are shaping where and how drywall is utilized, leading to a significant shift in segmental dominance.

Commercial Construction Leads the Way: The non-residential sector has firmly established itself as the primary growth engine for drywall. By 2027, drywall consumption in offices, hotels, hospitals, educational institutions, and other commercial and institutional buildings is projected to reach an impressive 6.8 billion square meters, marking an annual growth rate of approximately 3.4%9. This stands in stark contrast to the residential segment, which is expected to remain relatively flat, hovering around 5.4 billion square meters through the same period10. This means that by 2027, non-residential construction will account for over 55% of the total drywall volume, a gap that is set to widen31.

Several factors contribute to this non-residential surge. A key driver is the post-pandemic rebound in sectors such as office and hospitality construction. Businesses are investing in upgrading office spaces to meet new work models, and the revival of travel is spurring new hotel developments. Governments globally are also fueling this demand through significant investments in public infrastructure, including schools, hospitals, and administrative buildings, as a means to stimulate economic recovery and growth1112. Drywall’s inherent advantages — speed of installation, design flexibility, and consistency — make it a preferred choice for large-scale commercial projects, where efficiency and adherence to strict timelines are paramount. Furthermore, multinational contractors often standardize on drywall for interior partitions and ceilings in such projects, introducing these methods to new markets32.

Urbanization as a Catalyst: Rapid urbanization, particularly in Asia-Pacific and Africa, is a crucial underlying factor fueling commercial construction and, consequently, drywall adoption. As urban populations swell and cities expand, there is an urgent need for new infrastructure, commercial centers, residential complexes, and public facilities. Drywall provides a rapid and cost-effective solution for creating interior spaces in these large-scale developments. In many developing countries, drywall is first embraced in commercial and retail environments led by international developers, rather than in traditional homebuilding which may still rely on cheaper masonry or plaster28. Countries like India, Thailand, and Indonesia are experiencing significant increases in drywall use, especially in high-rise construction and prefabricated housing units designed to accommodate growing urban populations efficiently33.

While drywall is standard in North American homes (e.g., ~11 m² per capita in the U.S.26), its penetration in homebuilding in many other regions remains limited. In some parts of Western Europe and Japan, stagnant housing starts further constrain residential drywall growth34. This contrast highlights that the primary market opportunity for drywall expansion currently lies in the commercial and institutional sectors of rapidly urbanizing regions, where the benefits of modern “dry construction” techniques are quickly realized and adopted.

1.4 Pricing Volatility and Supply Chain Normalization

The global drywall market has experienced significant pricing volatility in recent years, largely a consequence of unprecedented supply chain disruptions and surging demand. The early 2020s marked a period of steep cost inflation, creating substantial challenges for contractors and developers.

Pandemic-Era Price Surges: During 2021 and 2022, drywall prices escalated dramatically. In the United States, wallboard prices recorded increases for seven consecutive quarters, with a staggering 8% jump in Q3 2022 alone13. By this point, U.S. drywall prices had reached their highest levels in decades, even surpassing the peaks observed during the robust 2020 housing boom35. This inflationary pressure was not unique to the U.S.; global drywall price indexes in 2022 were reportedly 20–30% above pre-pandemic norms.

The primary drivers behind this sharp increase were multifaceted:

- Soaring Input Costs: Essential raw materials, particularly gypsum, paper (for the board facings), and energy (especially natural gas for kiln drying), saw significant price hikes36. Geopolitical events and global energy crises further exacerbated these costs.

- Supply Chain Disruptions: The COVID-19 pandemic led to widespread factory shutdowns, labor shortages, and logistical bottlenecks, constraining production and transportation. Manufacturers struggled to keep pace with demand, resulting in acute shortages and extended lead times. Contractors faced delays, with typical 1–2 week deliveries stretching to 6–8+ weeks in some regions3738.

- Robust Demand: Despite the logistical challenges, strong construction and renovation activity, particularly in residential sectors fueled by low interest rates and a desire for more living space, maintained high demand for building materials like drywall.

Stabilization and Normalization: Entering 2023, the market began to show signs of stabilization. Industry reports indicated that by late 2022, drywall material supply had “begun to stabilize” following the previous shortages39. As supply chains improved globally and construction activity normalized, the intense upward price pressures started to ease. Consequently, drywall prices leveled off in 2023. Industry analysts now forecast a return to more typical inflation rates, approximately 2–3% annually, for building materials by 202440. This normalization trend is further evidenced by the projection that the global drywall market value will slightly decrease from $23.3 billion in 2022 to $22.7 billion by 2027, even as volume increases15. This decline in value reflects the subsidence of the elevated pricing that characterized the supply crunch.

While the immediate crisis has passed, the experience of recent years has prompted the industry to focus on creating more resilient supply chains. Strategies include localizing gypsum sourcing, maintaining surge production capacity, and actively pursuing recycling initiatives to buffer against future disruptions. Despite the stabilization, overall material costs remain approximately 25% higher than 2020 levels in some markets41, indicating a new baseline relative to the pre-pandemic era.

1.5 Technological Innovations and Labor Efficiency

The persistent challenge of skilled labor shortages within the drywall industry is proving to be a powerful catalyst for technological innovation, particularly in robotics and automation. A significant 20% gap is estimated in the availability of skilled drywall installers, especially in developed markets, necessitating solutions that enhance productivity and reduce reliance on demanding manual labor16.

The Rise of Robotics: Robotic systems are no longer confined to manufacturing floors but are increasingly making their way onto construction sites. For drywall, these robots are designed to tackle repetitive, physically taxing, and often injury-prone tasks. Examples include:

- Robotic Sanding and Finishing: Automated systems equipped with AI guidance can apply joint compound and sand surfaces with remarkable precision. On a commercial project in Pennsylvania (the “Netflix House” experience center), an AI-guided drywall sanding robot demonstrated a 300% to 400% increase in productivity (3-5 times faster) for Level 4/5 finishes compared to manual methods1842. This not only speeds up work but also significantly reduces worker fatigue, especially for overhead sanding tasks1742.

- Automated Lifting and Placement: Robots are being developed to handle heavy drywall sheets, particularly for ceiling installations. What traditionally required multiple workers can now be managed by one worker with robotic assistance, dramatically reducing strain and improving safety17.

These innovations address the dual challenges of labor scarcity and the physical demands of drywall work. Early adopters report that robotics lead to more consistent quality, fewer callbacks for corrections, and an overall reduction in injuries associated with repetitive motions1743. While still in their emerging phase, the market for wall-plastering robots is projected to grow significantly, with forecasts predicting a ~12% annual increase, reaching over $1 billion by 202844. This indicates a growing appetite among contractors to invest in labor-saving technologies to maintain project schedules and overcome workforce limitations.

Advanced Drywall Materials and Tools: Alongside robotics, the materials themselves and manual tools are also evolving. Lightweight drywall panels, which are typically 20–30% lighter than standard boards, have been widely adopted, easing the physical burden on installers. Specialized boards offering enhanced moisture resistance, mold protection, soundproofing, and fire resistance are becoming standard, with approximately 46% of new construction projects globally incorporating such performance-oriented drywall22. Paperless drywall, with fiberglass facings, specifically targets mold prevention in damp environments. Moreover, advances in finishing tools, such as lighter automatic taping tools and dust-reducing sanding systems with vacuum attachments, improve both efficiency and worker health. Quick-setting and low-dust joint compounds further streamline the finishing process, allowing for faster curing times and cleaner job sites. These material and tool innovations collectively contribute to a more efficient, less physically demanding, and higher-quality drywall plastering process.

1.6 Sustainability and Environmental Concerns

Sustainability has rapidly risen to the forefront of industry concerns, addressing the environmental footprint of drywall throughout its lifecycle. From raw material extraction to disposal, the industry faces mounting pressure to adopt more eco-friendly practices.

Environmental Impact of Production and Waste:

- Resource Extraction: The mining and production of gypsum, the core material, inherently carry a carbon footprint. While some manufacturers are making strides, the energy-intensive processes contribute to greenhouse gas emissions.

- Waste Generation: Drywall waste represents a significant environmental problem. Construction and demolition (C&D) debris, which includes gypsum board, constitutes an estimated 30–40% of global landfill waste19. In the U.S. alone, millions of tons of drywall scrap are generated each year.

- Low Recycling Rates: Despite gypsum’s recyclability, the current recycling rate for drywall is remarkably low. In the United States, only about 2% of gypsum drywall waste is recycled into new wallboard20. The vast majority ends up in landfills.

- Hazardous Landfill Emissions: When landfilled with organic municipal solid waste, gypsum can decompose under anaerobic conditions to produce hydrogen sulfide gas21. This gas is characterized by a “rotten-egg” odor and can be toxic in higher concentrations, posing environmental and public health risks near landfill sites.

Emerging Sustainable Solutions: Recognizing these challenges, governments and the industry are implementing stricter regulations and investing in greener solutions:

- Landfill Restrictions: Some jurisdictions have already taken decisive action. The UK, for example, banned the co-disposal of gypsum with biodegradable waste in landfills in 2009 to prevent toxic gas formation, effectively mandating separate recycling or disposal45. Similar initiatives to boost drywall recycling or even ban its landfill disposal are being explored in U.S. states like Massachusetts and California.

- Manufacturer Initiatives: Leading producers are investing heavily in recycling infrastructure and sustainable production. Etex, a major building materials group, reported a 54% increase in its use of recycled gypsum since 2018, positioning itself as a leader in European gypsum recycling2246. Etex has also achieved a 20% reduction in absolute CO₂ emissions since 2018 through plant modernization and renewable energy adoption47. Similarly, China’s BNBM, one of the world’s largest producers, announced that all its Chinese drywall factories achieved “nearly zero emissions” in 2022 through improved dust collection, waste gypsum recycling, and cleaner energy usage48.

- Eco-Drywall Products: The market is witnessing a surge in “eco-drywall” product launches, with a 22% uptick in the last two years22. These products often feature higher recycled content, lower embodied carbon, or are produced using novel, more sustainable binders. Lightweight panels also contribute to sustainability by reducing material usage and transportation emissions.

- Alternative Gypsum Sources: The decline of synthetic gypsum (a byproduct of coal-fired power plants, which are being phased out globally) is pushing manufacturers to seek alternative gypsum sources, making recycled drywall an increasingly attractive feedstock495051. This aligns supply needs with environmental goals.

The imperative for sustainability is reshaping industry practices, driving innovation, and influencing regulatory frameworks, pushing the drywall sector towards a more circular economy model.

The evolving landscape of the global drywall market presents both opportunities and challenges. The growth in demand, particularly from commercial construction in emerging economies, signifies a dynamic market with considerable upside. However, cost volatility, labor shortages, and environmental mandates necessitate continuous innovation and adaptation. The next section of this report will delve deeper into the raw materials and manufacturing processes that underpin this industry, exploring the inputs, technologies, and challenges associated with drywall production.

2. Global Drywall Market Overview and Growth Projections

The global drywall market is a dynamic and expanding sector within the broader construction industry, characterized by robust demand, evolving regional dynamics, and a growing emphasis on sustainability and technological innovation. Drywall, also known as plasterboard or gypsum board, has become an indispensable building material worldwide due to its advantages in cost-effectiveness, ease of installation, fire resistance, and acoustic properties. This section provides a comprehensive analysis of the global drywall market, detailing current consumption figures, market values, growth projections to 2027, and the multifaceted factors influencing its expansion, including construction trends, regional adoption rates, and emerging challenges and opportunities.

2.1. Current Global Market Size and Forecasted Growth (2022-2027)

The global drywall market demonstrates a trajectory of steady growth, underscored by increasing adoption in both traditional and emerging economies. In 2022, worldwide drywall consumption reached an impressive **11.1 billion square meters**, representing a market value of approximately **$23.3 billion** at the manufacturer level. This marks a substantial increase of roughly 42% in volume from 2007, when global consumption stood at approximately 7.8 billion square meters [1][2][3]. Looking ahead, industry forecasts predict continued moderate expansion. Global drywall demand is projected to grow at an annual rate of approximately **1.8% through 2027**, reaching an estimated **12.2 billion square meters** [4]. This moderate growth outlook is largely supported by a post-pandemic recovery in construction activity and the ongoing adoption of modern construction methods in developing regions. While volume is expected to increase, the market value is anticipated to experience a slight contraction. Following significant price surges during 2021-2022 due to pandemic-related supply chain disruptions and elevated raw material costs, prices are expected to normalize as supply chains stabilize. Consequently, the global market value is projected to tick down slightly to **$22.7 billion by 2027** [5][6]. This indicates that while more drywall will be consumed, unit prices are expected to ease from their recent peaks. The Freedonia Group (2024) elaborates that product usage intensity varies considerably across countries. For instance, North America has historically shown significantly higher per-capita usage compared to the global average [7]. This disparity highlights both the maturity of certain markets and the significant growth potential in others as they transition towards more industrialized building practices.

Table 2.1: Global Drywall Market Size and Projections (2022 vs. 2027)

| Metric | 2022 Data | 2027 Projection | Annual Growth Rate (2022-2027) |

|---|---|---|---|

| Global Consumption Volume | 11.1 billion m² | 12.2 billion m² | ~1.8% |

| Global Market Value | $23.3 billion | $22.7 billion | Slight decline (due to price normalization) |

2.2. Regional Dynamics and Dominant Markets

The global drywall market is experiencing a notable shift in regional dominance, moving away from its historical concentration in North America towards the Asia-Pacific region.

2.2.1. China’s Pivotal Role in Market Expansion

China has emerged as the unequivocal leader in the global drywall market. Critically, China is projected to drive approximately **44% of global drywall demand gains through 2027** [8][9]. After a period of sluggish performance in 2022, primarily attributed to stringent Zero-COVID policies and real estate slowdowns, China’s drywall consumption is accelerating once more. This resurgence is fueled by a significant shift in its construction sector, particularly in commercial buildings, where traditional plaster and concrete methods are increasingly being replaced by modern drywall techniques [10]. The *Freedonia Group (2024)* anticipates that Chinese market growth will “accelerate from the 2017–2022 pace” [11]. As both the largest producer and consumer, China’s economic and construction trends have an outsized influence on the global drywall landscape.

2.2.2. North America: A Mature but Significant Contributor

The United States, while experiencing slower growth compared to emerging markets, remains the second-largest drywall market globally. The nation saw a robust post-pandemic recovery, with approximately **28 billion square feet (approximately 2.6 billion m²) of wallboard sold in 2024**, nearing its mid-2000s record levels [12][13]. This rebound was significantly influenced by a housing recovery and increased renovation activities. In terms of raw materials, U.S. gypsum consumption reached an estimated **45 million tons in 2023** for various products including wallboard [14]. However, the Gypsum Association (2024) suggests that future growth in the U.S. may level off due to factors like higher interest rates and elevated construction costs. Historically, in 2007, North America accounted for nearly half of global drywall usage [15]; however, its share has been progressively overtaken by the Asia-Pacific region as developing markets expand their adoption of drywall.

2.2.3. Per Capita Usage Disparities and Emerging Market Potential

Drywall usage presents significant per capita disparities globally, reflecting diverse construction traditions and economic development levels. North America leads with notably high per-capita usage; for example, the U.S. averages approximately **11 square meters of drywall per person per year**, and Canada about 10 m², underscoring its ubiquitous presence in residential construction [16]. In stark contrast, many European and developed Asian countries exhibit per-capita usage ranging from **1 to 2 square meters**, where traditional methods like masonry and wet plaster remain common [17]. Some cultures, such as Italy and Taiwan, historically showed even lower uptake, near the world average of about 1.2 square meters per person [18]. These significant differences highlight immense growth potential. As global preferences shift, and modern, efficient building techniques become more widespread, countries with low current drywall penetration offer substantial upside for future demand. The global market is gradually moving towards a convergence, with more regions expected to adopt drywall at levels closer to developed countries, thereby increasing the global average consumption. Developing regions like South Asia and the Middle East are already demonstrating above-average growth rates in drywall production and consumption [19].

Table 2.2: Drywall Per Capita Usage in Selected Regions (Approximate)

| Region/Country | Approximate Annual Per Capita Drywall Usage | Primary Construction Method Influence |

|---|---|---|

| United States | ~11 m² | Wood/steel frame, standard for interiors |

| Canada | ~10 m² | Wood/steel frame, standard for interiors |

| Many European/Developed Asian Countries | 1–2 m² | Masonry, wet plaster remains common |

| Italy/Taiwan (Historically) | ~1.2 m² | Traditional masonry, wet plaster dominant |

2.3. Factors Influencing Market Expansion

2.3.1. Commercial Construction as a Primary Demand Driver

A significant trend shaping the global drywall market is the accelerating demand from the non-residential construction sector. Offices, hotels, institutions, and other commercial structures are now the dominant and faster-growing segment for drywall. Projections indicate that drywall use in non-residential buildings will reach **6.8 billion square meters by 2027**, growing at an impressive **~3.4% annually** [20][21]. This significantly outpaces the residential segment, which is expected to remain relatively flat at around **5.4 billion square meters through 2027** [22]. The growth in non-residential construction is propelled by several factors:

- Post-pandemic rebound: A resurgence in office development and upgrades, alongside a recovery in the hospitality sector, contributes substantially to demand as businesses modernize spaces and travel resumes [23].

- Government investments: Public infrastructure projects, such as schools and hospitals, funded by governments seeking to stimulate economies, heavily utilize drywall for its efficiency and design flexibility [24].

- Urbanization: Rapid urbanization, particularly in Asia and Africa, leads to the construction of large-scale commercial and mixed-use developments where drywall is favored for speed and modern aesthetics [25] [26].

- Standardization by multinational builders: International construction firms often standardize on drywall for interior partitions and ceilings due to its inherent advantages, facilitating its adoption in new markets, especially in commercial projects where speed is critical [27].

By 2027, non-residential construction is expected to account for over 55% of the total drywall volume, with this gap between non-residential and residential consumption continuing to widen [28].

2.3.2. Evolution of Residential Segment and Regional Adoption

While the non-residential sector leads in growth, the residential segment presents a more nuanced picture. In North America, drywall remains standard in homebuilding. However, in lower-income countries, traditional methods like masonry or plaster often persist in home construction, primarily due to cost considerations [29]. In these regions, drywall is typically first embraced in commercial and retail construction, often introduced by multinational developers, before gradually penetrating the residential market. Stagnant housing starts in mature markets like parts of Western Europe and Japan are also limiting residential drywall growth [30]. Despite these challenges, opportunities exist within the residential sphere:

- Renovation and remodeling: Developed markets experience significant drywall demand from renovation and remodeling activities. The U.S., for example, saw a renovation boom during 2020-2022 that drove substantial drywall sales.

- Disaster rebuilding: Areas affected by natural disasters frequently require massive quantities of drywall for reconstruction, leading to temporary spikes in local demand.

- Affordable housing and prefabrication: In developing countries, affordable housing initiatives embracing prefabrication and “dry construction” methods can accelerate drywall adoption, offering faster and more efficient building solutions [31].

The overall residential drywall demand is expected to remain flat in volume over the near term, with significant uptake dependent on the widespread modernization of housing construction techniques in developing regions [32].

2.3.3. Key Players and Market Structure

The global drywall market is characterized by a significant degree of consolidation, with a handful of multinational firms exerting substantial influence. The leading manufacturers are:

- Knauf (Germany)

- Beijing New Building Materials (BNBM), part of state-owned CNBM (China)

- Saint-Gobain (France) [33]

Other major players include Eagle Materials and Georgia-Pacific (U.S.). BNBM, for instance, sold **2.09 billion square meters of wallboard in 2022**, equating to roughly 19% of global demand [34]. These companies pursue growth through both acquisitions and strategic new factory investments in high-growth regions. Examples include Saint-Gobain’s new drywall plants in India and China, and Knauf’s facility in Uzbekistan [35]. While market shares are often regionally concentrated (e.g., BNBM/CNBM dominate China, USG and National Gypsum lead in North America), cross-border expansion is a key strategy. Asian manufacturers, such as BNBM/CNBM, are increasingly investing in plants in Africa and the Middle East, while Western firms continue to expand their footprint in Asia [36]. This competitive dynamic ensures that the market remains responsive to regional growth drivers and technological advancements.

2.4. Price Volatility and Supply Chain Resilience

The early 2020s presented significant challenges to the drywall market, primarily due to unprecedented price volatility and supply chain disruptions.

2.4.1. Surging Prices (2021-2022)

During 2021-2022, the global drywall industry experienced severe price inflation. In the U.S., wallboard prices climbed for **seven consecutive quarters through Q3 2022**, with an **8% jump in Q3 2022 alone** [37][38]. This pushed average drywall prices to their highest levels in decades, surpassing even the previous peaks during the 2020 housing boom [39]. The primary drivers for this escalation included:

- Soaring input costs: Raw materials such as gypsum, paper, and energy (for kiln drying) experienced significant price hikes [40].

- Pandemic-related disruptions: Global supply chains were severely strained, impacting production and logistics capabilities.

- High demand: Strong renovation and new construction demand, particularly in the residential sector, contributed to upward price pressure [41].

Globally, drywall price indexes in 2022 were 20-30% above pre-pandemic norms, with many contractors facing extended lead times of 6-8+ weeks, up from the usual 1-2 weeks [42][43].

2.4.2. Stabilization and Future Outlook for Pricing

By late 2022 and throughout 2023, the situation improved markedly. Drywall supply chains began to stabilize as manufacturers caught up with demand and disruptions eased [44]. Demand normalization also contributed to abating price pressures [45]. Consequently, drywall prices leveled off in 2023, and industry analysts anticipate a return to more normal inflation rates of approximately **2-3% annually by 2024** for building materials [46]. Despite this stabilization, overall material costs still remain about 25% higher than 2020 levels [47]. The *Freedonia Group* projects that the global drywall market value will slightly decrease from $23.3 billion in 2022 to **$22.7 billion by 2027**, even with volume growth, reflecting the normalization of previously elevated pricing [48]. This shift provides some relief for builders and project budgets.

2.5. Sustainability Challenges and Opportunities

The drywall industry faces increasing scrutiny regarding its environmental footprint, prompting significant efforts toward sustainability and circularity.

2.5.1. Waste Management and Recycling

Construction and demolition (C&D) debris constitutes a substantial portion of global landfill waste, estimated at **30-40%** [49][50]. Gypsum drywall is a major contributor to this stream. Despite its recyclability, recycling rates for drywall are remarkably low. In the United States, only about **2% of gypsum drywall waste is recycled into new wallboard** [51]. The vast majority ends up in landfills, where it poses environmental hazards. When mixed with organic waste, gypsum can decompose and release **toxic hydrogen sulfide gas**, which carries a distinct “rotten egg” odor and can be dangerous in high concentrations [52]. This environmental concern has led to stricter regulations in some regions. For example, the UK’s Environment Agency banned the co-disposal of gypsum drywall with biodegradable waste in landfills in 2009, effectively mandating separate recycling [53]. This regulatory push, combined with rising landfill costs and a dwindling supply of synthetic gypsum, is spurring industry and entrepreneurial efforts in recycling. Companies like USA Gypsum and waste management firms like DTG Recycle are emerging to collect and process drywall scrap for reuse in agriculture, cement, and new wallboard production [54].

2.5.2. Raw Material Supply Shifts: Decline of Synthetic Gypsum

A critical unaddressed challenge for drywall manufacturers is the changing availability of gypsum raw materials. Historically, a significant portion of gypsum came from **synthetic gypsum**, a byproduct of coal-fired power plant flue-gas desulfurization. However, the global transition away from coal-fired power for environmental reasons has led to a dwindling supply of this synthetic source. In the U.S. and EU, numerous coal plants have closed or reduced output since 2015, directly impacting synthetic gypsum availability [55]. The decline of synthetic gypsum necessitates a greater reliance on **mined natural gypsum** or increased recycling. Importing natural gypsum is costly due to its bulk and low value-to-weight ratio [56]. This dynamic makes recycling scrap drywall an increasingly attractive and economically viable source of gypsum feed material for manufacturers, aligning sustainability goals with supply security [57].

2.5.3. Emergence of “Greener” Drywall Solutions

In response to environmental concerns, the industry is increasingly investing in “greener” drywall solutions. Major producers like Etex have made significant strides, reporting a **54% increase in recycled gypsum usage since 2018** and a **20% reduction in absolute CO₂ emissions** across their operations [58][59]. Innovations include:

- Higher recycled content: Boards incorporate more recycled gypsum, reducing demand for virgin materials.

- Lightweight boards: Reduced material per square meter helps cut transportation emissions and handling effort.

- Lower carbon production: Investments in modernizing plants, using renewable energy, and optimizing logistics are reducing the carbon footprint of manufacturing.

- Eco-drywall product launches: The market has seen a **22% uptick in “eco-drywall” products** in the last two years, indicating growing demand for sustainable options [60].

These efforts align with builder and consumer demand for materials that contribute to green building certifications and improved indoor air quality.

2.6. Impact of Technology and Labor Dynamics

2.6.1. Robotics and Automation in Drywall Plastering

A critical factor influencing drywall plastering is the persistent **shortage of skilled labor**, estimated at a **20% gap** in developed markets [61]. This has driven a significant interest in automation and robotics to boost productivity and reduce manual labor.

- Robotic finishing: Autonomous drywall finishing robots can perform repetitive tasks like sanding and joint compound application, especially on large commercial projects. A notable example is the “Netflix House” project in Pennsylvania, where an AI-guided sanding robot achieved a **five-fold (300%+) increase in surface finishing productivity** for Level 4/5 finishes, while also reducing worker fatigue [62] [63].

- Robotic lifts: Mechanical lifts can handle heavy drywall sheets for ceiling installations, reducing the need for multiple workers and minimizing physical strain [64].

These robots deliver consistent quality, minimize rework, and address the inherent challenges of strenuous and repetitive drywall work [65][66]. The market for wall-plastering robots is projected to grow ~12% annually, exceeding **$1 billion by 2028**, indicating a significant future investment in these labor-saving technologies.

2.6.2. Advances in Drywall Materials and Tools

Beyond robotics, innovations in the drywall product itself and associated tools are enhancing efficiency and performance:

- Lightweight panels: Boards that are **20-30% lighter** than standard drywall have gained widespread adoption since their introduction in the 2010s, reducing handling labor and improving ergonomics.

- High-performance boards: Specialized products like **paperless drywall** (with fiberglass facings) offer enhanced mold and moisture resistance. Other performance-driven boards provide superior soundproofing, impact resistance, and fire resistance. Approximately **46% of new construction projects globally** incorporate specialized drywall for better performance [67].

- Improved finishing tools: Automatic taping tools are becoming lighter and more efficient, speeding up joint compound application. Dust-reducing sanding tools with vacuum attachments improve site cleanliness and worker health.

- Advanced compounds: Quick-setting and low-dust joint compounds accelerate finishing times and improve indoor air quality.

These material and tool innovations collectively contribute to faster project completion times, reduced labor intensity, and higher quality finishes, making drywall a more competitive option in modern construction processes.

2.7. Conclusion and Transition to Next Section

The global drywall market is characterized by steady growth in volume, driven largely by non-residential construction and accelerating adoption in emerging economies, particularly China. While the market value is expected to stabilize after recent price surges, the underlying demand for drywall as a fast, efficient, and versatile building material remains robust. The industry is actively responding to challenges such as skilled labor shortages through automation and evolving its products to meet higher standards of sustainability and performance. The decline of synthetic gypsum and the imperative to reduce construction waste are pushing manufacturers towards greater recycling and greener production methods, shaping a more circular economy for drywall. The influence of international and local building codes, traditional construction practices, and the willingness of smaller contractors to adopt new technologies will dictate the pace of drywall penetration in different regions. As the market continues to evolve, understanding the nuances of localized demand, regulatory landscapes, and the competitive environment will be crucial for stakeholders. The next section will delve deeper into the specific application of drywall plastering, examining its technical aspects, best practices, and the role of specialized products in achieving desired performance criteria. This includes a detailed look at the various levels of finish, joint treatment, and the tools and materials used by plasterers to meet the market’s evolving demands for quality and efficiency.

3. Regional Market Dynamics: China, North America, and Emerging Economies

The global drywall market, while exhibiting steady overall growth, is characterized by a complex interplay of regional dynamics. Differing construction traditions, economic development trajectories, regulatory environments, and prevailing building technologies create distinct market landscapes across the world. This section delves into the significant regional variations, specifically focusing on China’s burgeoning demand, the mature yet stable North American market, and the unique patterns of growth and adoption challenges observed in emerging economies. By examining these diverse regional forces, a comprehensive understanding of the global drywall industry’s past, present, and future trajectory can be formed.

3.1 Global Drywall Market Overview: Shifting Power Centers and Consumption Patterns

The worldwide demand for drywall has shown robust and consistent growth over the past two decades. In 2022, global drywall consumption reached an impressive 11.1 billion square meters, representing a market value of approximately $23.3 billion at the manufacturer level [1]. This figure marks a substantial increase from approximately 7.8 billion square meters in 2007, indicating a significant rise in adoption as more countries embrace drywall construction methods [2]. Projections for the coming years anticipate continued moderate growth, with global demand expected to climb by roughly 1.8% annually, reaching an estimated 12.2 billion square meters by 2027 [3]. This moderate growth outlook from The Freedonia Group underscores a post-pandemic construction recovery and the ongoing expansion into emerging markets. However, it is crucial to note that while volume is increasing, the market value is predicted to slightly decrease to $22.7 billion by 2027 [4]. This anticipated decline in value, despite rising volumes, is primarily attributed to the normalization of gypsum board prices following the sharp increases observed during 2021–2022 when supply chain disruptions and raw material cost hikes pushed prices to record highs.

Historically, North America held a dominant position in the global drywall market. In 2007, the region accounted for nearly 48% of worldwide drywall sales [36]. However, this dynamic has fundamentally shifted. The Asia-Pacific region has now emerged as the largest market, largely driven by the colossal demand from China, which has surpassed the United States as the world’s leading drywall consumer. Together, China and the U.S. alone accounted for over 50% of global drywall output in 2022 [37]. Developing regions such as South Asia and the Middle East are also experiencing growth rates that exceed the global average, signaling a strategic pivot for international manufacturers towards these expanding territories [38]. In contrast, mature markets like North America and Western Europe are now characterized by slower, more stable growth [39], focusing more on renovation and specialized applications rather than rapid new construction expansion.

The intensity of drywall usage also varies significantly on a per-capita basis, reflecting diverse construction traditions and economic development stages. North America stands out with exceptionally high per-capita consumption. The United States, for instance, utilizes approximately 11 square meters of drywall per person per year, with Canada showing similar levels of around 10 square meters [40]. This high usage reflects the widespread adoption of light-frame construction and drywall as a standard interior finish in residential and commercial buildings across these countries. In contrast, many European and developed Asian nations exhibit considerably lower per-capita usage, typically ranging from 1 to 2 square meters [41]. This is largely due to the persistence of traditional masonry construction and wet plaster finishes. In certain cultures, drywall penetration remains minimal, with countries like Italy and Taiwan historically averaging around 1.2 square meters per person, close to the global average [42]. These disparities highlight significant growth potential in regions where the transition from traditional building methods to modern drywall techniques is still in its early stages. As preferences evolve and modern construction practices spread globally, countries with low current adoption rates present substantial upside for future drywall demand.

The global drywall market is dominated by a few multinational corporations that exert considerable influence over production and supply chains. Key players include Knauf (Germany), Beijing New Building Materials (BNBM), which is part of the state-owned China National Building Material (CNBM) group and the world’s largest producer by volume, and Saint-Gobain (France) [18]. Other significant firms in the industry’s top tier include Eagle Materials and Georgia-Pacific (U.S.) [19]. These companies operate vast production networks and have strategically expanded their footprints through targeted acquisitions and the establishment of new manufacturing facilities in high-growth regions. For example, Saint-Gobain has recently inaugurated new gypsum board plants in rapidly developing markets like India and China, reflecting a strategic response to localized demand surges [20]. Similarly, BNBM alone sold an impressive 2.09 billion square meters of wallboard in 2022 [21], accounting for nearly 19% of global demand, underscoring its immense scale and China’s central role in the industry. The market exhibits regional concentration, with specific manufacturers dominating their home territories (e.g., Knauf and Saint-Gobain in Europe, BNBM/CNBM in China, and USG and National Gypsum in North America). However, competitive dynamics are evolving, with Asian manufacturers increasingly expanding their overseas operations, such as BNBM/CNBM’s investments in Africa and the Middle East, while Western firms continue to penetrate Asian markets, fostering a truly globalized competitive landscape.

3.2 China’s Accelerating Demand: The Global Growth Engine

China has firmly established itself as the world’s most significant drywall market, not only in terms of current consumption but also as the primary driver of future global growth. Despite experiencing a challenging year in 2022 due to stringent Zero-COVID lockdowns and a slowdown in its real estate sector, China’s drywall market is set for a substantial rebound and expansion. Forecasts indicate that China will account for approximately 44% of global drywall demand gains through 2027 [5]. The Freedonia Group projects that Chinese market growth will “accelerate from the 2017–2022 pace,” contributing nearly half of the global drywall volume increase over the 2022–2027 period [14].

3.2.1 Drivers of Chinese Drywall Growth

- Shift from Traditional Materials: A primary catalyst for China’s accelerating demand is the ongoing transition from traditional building materials, such as wet plaster or concrete, to modern drywall systems. This shift is particularly pronounced in the country’s rapid urbanization and the construction of new commercial and institutional buildings [6].

- Commercial Construction Boom: Much of China’s projected growth in drywall consumption is concentrated in the non-residential sector, including offices, hotels, educational institutions, and urban commercial projects. Drywall offers advantages in terms of speed of installation, design flexibility, and consistency, which are highly valued in large-scale commercial developments.

- Government Initiatives and Urbanization: The Chinese government’s continued investment in public infrastructure, coupled with an accelerated pace of urbanization, particularly in second and third-tier cities, fuels significant construction activity. Drywall is increasingly being adopted in these large-scale projects to meet ambitious construction timelines and efficiency targets.

- Modern Building Techniques: As China’s construction industry modernizes, there is a growing embrace of industrialized building methods, including prefabrication and dry construction techniques. Drywall panels are well-suited for these methods, which reduce on-site labor and construction time.

The rebound in China’s construction sector, particularly after the temporary setbacks of the Zero-COVID policy, underscores the country’s outsized influence on global drywall trends. As the largest drywall producer and consumer worldwide, China’s domestic market performance directly impacts the global industry. In 2022, Beijing New Building Materials (BNBM), a leading Chinese drywall producer, experienced a 12% year-on-year drop in sales volume to 2.09 billion square meters, primarily due to the domestic real estate slowdown [21]. However, BNBM simultaneously pursued international expansion and environmental upgrades, demonstrating resilience and adaptability in a volatile market [82]. The anticipated recovery and sustained growth in China’s commercial construction sector are expected to significantly boost overall global drywall demand in the coming years.

3.3 North America: A Mature but Steady Market

The North American drywall market, historically the global leader, now represents a mature but steady segment of the industry. Despite being surpassed by Asia-Pacific in overall consumption, the United States remains the second-largest drywall market globally, characterized by high per-capita usage and a well-established infrastructure. After recovering from the severe downturn following the 2008–2011 housing crisis, the U.S. market has shown robust performance. In 2024, the United States saw approximately 28 billion square feet (roughly 2.6 billion square meters) of wallboard sold, approaching the record levels seen in the mid-2000s [22]. This rebound has been supported by a resurgence in housing demand and renovation activities.

3.3.1 Key Characteristics and Trends in North America

- High Per-Capita Consumption: As mentioned, the U.S. exhibits an exceptionally high per-capita drywall usage of approximately 11 square meters per year [8]. This reflects drywall’s omnipresence in both residential and commercial construction, particularly given the prevalence of light-frame construction methods that are well-suited for drywall applications.

- Gypsum Consumption: The scale of the North American industry is further highlighted by its raw material consumption. In 2023, approximately 45 million metric tons of gypsum were used in the U.S. for wallboard production, cement, and other applications [23].

- Post-Pandemic Revival & Leveling Growth: The U.S. market experienced a strong post-pandemic revival, with a surge in residential and renovation activity. However, future growth is anticipated to level off. The Gypsum Association notes that U.S. drywall shipments have largely returned to pre-recession volumes, but higher interest rates and elevated construction costs may temper stronger gains in the near future.

- Dominance of Non-Residential Sector: Similar to global trends, the non-residential sector is increasingly driving drywall demand in North America. By 2027, non-residential drywall use is projected to reach 6.8 billion square meters globally, growing at ~3.4% annually, significantly outpacing the residential segment [9]. This trend is driven by a post-pandemic rebound in commercial building, government investments, and the continuous need for modern office, retail, and institutional spaces [11].

- Renovation and Remodeling: A significant portion of residential drywall demand in North America comes from renovation and remodeling, rather than just new construction. The renovation boom of 2020–2022, spurred by remote work and homeowners investing in their properties, led to substantial drywall sales for home improvements and extensions.

- Disaster Rebuilding: North America is also susceptible to natural disasters, and rebuilding efforts often create temporary surges in drywall demand. Following hurricanes, floods, or wildfires, large quantities of new drywall are required to replace damaged interiors, sometimes leading to localized shortages.

While the North American market may not exhibit the explosive growth rates seen in emerging economies, its sheer volume, established industry infrastructure, and consistent demand from both new construction and renovation projects ensure its continued importance in the global drywall landscape. The industry is focused on maintaining efficiency, adapting to evolving building codes (e.g., for fire and sound), and addressing labor shortages through technological adoption.

3.4 Emerging Economies: Growth Patterns and Adoption Challenges

Emerging economies across South Asia, Southeast Asia, Africa, and parts of Latin America represent the next frontier for significant drywall market expansion. These regions are characterized by large and growing populations, increasing urbanization, and improving economic conditions, leading to immense construction needs. While the current per-capita drywall usage in many of these markets is low compared to North America, the potential for growth is substantial as traditional construction methods give way to modern techniques.

3.4.1 Growth Drivers in Emerging Markets

- Rapid Urbanization: Cities in emerging economies are expanding at an unprecedented rate, necessitating the rapid construction of high-rise residential buildings, commercial complexes, and public infrastructure. Drywall offers faster installation and greater efficiency compared to traditional masonry, making it attractive for such projects [12].

- Infrastructure Development: Governments in these regions are heavily investing in developing modern infrastructure, including new hospitals, schools, transportation hubs, and government buildings. These large-scale projects often adopt international building standards and modern materials like drywall.

- Foreign Direct Investment and International Developers: Multinational construction firms and developers operating in emerging markets often bring with them Western building practices, which typically rely on drywall for interior partitions and ceilings. For instance, Saint-Gobain and Knauf have strategically established new board plants in India and Uzbekistan, respectively, to cater to rising local demand [20].

- Affordable Housing Initiatives: In some emerging economies, affordable housing programs are exploring prefabricated and modular construction methods as a means to rapidly deliver housing units. Drywall is a key component in these systems, offering faster build times and reduced on-site labor requirements.

3.4.2 Adoption Challenges in Emerging Markets

Despite the significant growth potential, drywall adoption in emerging economies faces several challenges:

- Cultural and Traditional Preferences: Many cultures in developing countries have long-standing traditions of using masonry (brick or concrete blocks) for walls, often perceived as more durable or insulating. Shifting these deeply ingrained preferences, particularly in residential construction, can be slow. Homebuilders may stick to cheaper masonry or plaster for housing while multinational builders embrace drywall for commercial projects [10].

- Cost Sensitivity: In many lower-income settings, initial material cost is a critical factor. While drywall can offer long-term cost benefits through faster construction and reduced labor, the upfront material cost may be higher than locally sourced traditional materials.

- Lack of Skilled Labor and Training: The existing labor force in emerging markets may be highly skilled in traditional plastering and masonry but lack the expertise required for drywall installation and finishing. This necessitates significant investment in training and skill development to support widespread adoption, though there is a short-term labor gap [27].

- Supply Chain and Logistics: Establishing efficient supply chains for drywall, including manufacturing, distribution, and access to necessary ancillary materials (like joint compound, tape, and fasteners), can be challenging in regions with underdeveloped infrastructure. Countries like India, Thailand, and Indonesia are identified as high-growth markets that are rapidly adopting drywall, especially in high-rise and prefabricated construction [46].

- Building Codes and Regulations: Local building codes may not always be updated to fully accommodate or standardize drywall usage, or they may lack the necessary enforcement mechanisms. This can create uncertainty for developers and hinder widespread adoption.

- Environmental Concerns: While modern drywall offers sustainability advantages, waste management, including recycling, can be a major challenge in countries with nascent recycling infrastructure. The low recycling rate of drywall globally (only ~2% in the U.S. [15]) is an even greater concern in regions with less developed waste management systems.

The pace of drywall adoption in emerging markets often follows a distinct pattern: it is typically embraced first in large-scale commercial and government projects, where speed, efficiency, and modern aesthetics are prioritized. Residential adoption tends to be slower, especially in low-income segments, but gains traction as urbanization increases, labor costs rise, and the benefits of dry construction become more apparent. Examples such as the construction of new megacities or smart cities (e.g., Egypt’s new capital city, Saudi Arabia’s NEOM project) often integrate Western building practices, including extensive drywall use, contributing to regional growth.

The global outlook points towards a gradual convergence, wherein more emerging regions will integrate drywall into their construction practices at rates approaching those of developed nations, thereby elevating overall global consumption. This will require sustained efforts in education, infrastructure development, and policy reform to overcome existing barriers and unlock the full potential of these dynamic markets. The growth in these regions, albeit from a smaller base, is vital for the continued moderate expansion of the global drywall market, influencing manufacturing capacities and strategic investments by leading players.

The regional market dynamics highlight a global industry in transition. China’s immense demand and North America’s mature stability offer a backdrop against which the unique opportunities and challenges of emerging economies are unfolding. Understanding these regional nuances is critical for manufacturers, suppliers, and contractors aiming to navigate the evolving landscape of drywall plastering effectively.

4. Market Segmentation: Residential vs. Non-Residential Demand

The global drywall market, a cornerstone of modern construction, exhibits distinct demand patterns across its primary segments: residential and non-residential construction. Understanding these segments is crucial for industry stakeholders, as their individual growth trajectories, adoption rates, and specific requirements significantly influence market strategies, product development, and regional investment. While residential construction has historically been a foundational driver for drywall demand in mature markets, the non-residential sector has emerged as the dominant growth engine globally, projected to expand at a considerably faster pace. This section will delve into the demand drivers from both residential and non-residential construction sectors, highlight the segment currently experiencing faster growth, and explore the implications of these trends for the broader drywall industry.

4.1 Evolution of Drywall Demand Across Construction Sectors

The journey of drywall from its invention to its current ubiquity in construction has seen varying adoption rates across different building types and geographical regions. In its nascent stages and early widespread adoption, particularly in North America, drywall primarily found its stride in residential building. Its ease of installation, fire resistance, and smooth finish made it a superior alternative to traditional wet plaster for interior walls and ceilings in homes. However, market dynamics have shifted considerably over the decades, leading to a new hierarchy of demand. Globally, the drywall market, valued at approximately **$23.3 billion** in 2022 with a volume of **11.1 billion square meters** of consumption, is anticipated to reach **12.2 billion square meters by 2027**, growing at a moderate annual rate of approximately **1.8%** [1],[3]. This aggregate growth, however, masks a fundamental divergence between the residential and non-residential segments. The Freedonia Group notes that product usage intensity varies widely by country, with North America historically exceeding the global per-capita average [13]. This historical context is vital in understanding the current state of market segmentation. In many developing economies, the introduction and widespread adoption of drywall often follow a specific trajectory. Drywall is first embraced in commercial and institutional settings, such as offices, retail spaces, and hotels, often driven by multinational builders seeking efficient, standardized construction methods. Homebuilders, particularly in lower-income countries, tend to stick to more traditional and often cheaper masonry or plaster alternatives [5]. This pattern of adoption has a profound effect on the overall market segmentation on a global scale, contributing to the faster growth observed in the non-residential sector.

4.2 Non-Residential Construction: The Dominant Growth Engine

The non-residential sector has firmly established itself as the larger and more rapidly expanding market for drywall globally. This segment encompasses a broad range of structures, including commercial offices, retail establishments, hotels, educational institutions, healthcare facilities, and public infrastructure projects. Projections indicate that drywall use in these non-residential buildings is set to reach **6.8 billion square meters by 2027**, demonstrating a robust annual growth rate of approximately **3.4%** [4]. This represents a significant acceleration and leadership in demand, far outpacing the residential counterpart. Several factors underpin this strong performance:

4.2.1 Urbanization and Infrastructure Development

Rapid urbanization, particularly in Asia and Africa, is a principal driver. As cities expand and populations grow, there is an immense need for new commercial and public infrastructure. Governments are investing heavily in public infrastructure projects, including schools, hospitals, and administrative buildings, to support this growth. These large-scale projects often adopt modern construction techniques, where drywall is preferred for its speed of installation, design flexibility, and structural efficiency [6],[7]. The ability to complete interior fit-outs quickly and efficiently makes drywall an attractive option for developers facing tight deadlines and significant project scales.

4.2.2 Post-Pandemic Rebound and Commercial Upgrades

The non-residential market is experiencing a strong rebound following the pandemic-induced slowdown [7]. Many companies are upgrading existing office spaces or constructing new ones to meet evolving workplace demands, such as hybrid work models and enhanced health and safety standards. Similarly, the recovery of global travel and tourism is fueling new hotel constructions and renovations. These projects often prioritize interior aesthetics, acoustic performance, and fire safety, all attributes where specialized drywall products excel. Drywall systems can provide excellent sound insulation, critical for spaces like hotels and modern offices, and offer various fire ratings essential for compliance with stringent building codes in commercial properties.

4.2.3 Economic Stimulus and Government Investment

Governments worldwide are increasingly using infrastructure investment to stimulate flagging economies. Public projects, ranging from new government offices to renovated civic centers, leverage drywall for its cost-effectiveness, speed, and versatility. In China, for example, much of the growth in drywall demand is concentrated in modern non-residential construction, including offices and urban commercial projects, as builders transition from traditional masonry to drywall techniques [15]. This shift reflects a global trend towards embracing more industrialized and efficient construction methods over traditional, labor-intensive approaches.

4.3 Residential Construction: Flattening Demand in Mature Markets

In stark contrast to the dynamic growth in the non-residential sector, global residential drywall demand is projected to remain relatively stable, hovering around **5.4 billion square meters** through 2027 [5]. This stagnation is largely attributed to a combination of factors, primarily affecting mature markets.

4.3.1 Stagnant Housing Starts in Developed Economies

Many developed regions, including parts of Western Europe, Japan, and certain areas of the United States, are experiencing stagnant housing starts [9]. Factors such as aging populations, high interest rates, rising construction costs, and limited developable land contribute to a slowdown in new home construction. This directly impacts residential drywall consumption, as new builds are a primary source of demand.

4.3.2 Persistent Use of Traditional Building Methods

In various regions, particularly lower-income countries, traditional methods like masonry or wet plaster continue to dominate residential construction. These methods are often cheaper, easier for local laborers to implement with existing skills, and deeply ingrained in cultural building practices [5]. While drywall offers advantages in terms of speed and finish quality, the initial investment in training and equipment, as well as the perception of durability, can deter homebuilders from adopting it. This poses a significant barrier to residential drywall market expansion in these regions.

4.3.3 Market Maturity and Per Capita Usage Disparities

In highly developed markets like North America, drywall has already achieved near-saturation in residential construction. The United States, for instance, exhibits a per capita drywall usage of approximately **11 square meters annually** [8], indicating its widespread adoption in homes. In contrast, many European and developed Asian countries see per capita usage of only **1-2 square meters** [42], due to the prevalence of masonry and wet plaster. These disparities highlight that while high-penetration markets offer limited growth potential in new residential builds, low-penetration markets face challenges in shifting established building traditions. However, even within the residential segment, certain sub-sectors maintain importance: * **Renovation and Remodeling:** In mature markets, renovation and remodeling activities are significant drivers of residential drywall demand. Homeowners undertaking upgrades, expansions, or home office additions frequently use drywall. The U.S. witnessed a renovation boom in 2020–2022, which contributed to substantial drywall sales. * **Disaster Rebuilding:** Natural disasters often trigger localized spikes in residential drywall demand as damaged homes require extensive reconstruction. * **Affordable Housing Programs:** In some developing countries, government-backed affordable housing initiatives are exploring prefabricated or ‘dry construction’ methods, including drywall, to build faster and more economically. Despite these factors, the overall global trend for residential drywall demand is one of stability rather than significant growth, especially when compared to the non-residential sector.

4.4 Quantitative Comparison of Residential and Non-Residential Market Growth

To further illustrate the divergence in growth trajectories, a direct comparison of demand figures is essential.

| Market Segment | Projected Demand by 2027 (Billion m²) | Annual Growth Rate (2022-2027) | Share of Total Drywall Volume (2027) |

|---|---|---|---|

| Non-Residential | 6.8 | ~3.4% | >55% |

| Residential | ~5.4 | Flat | <45% |

| Global Total | ~12.2 | ~1.8% | 100% |

Derived from GlobeNewswire (ResearchAndMarkets) 2024 data [4],[5]The table clearly demonstrates that by 2027, non-residential construction is expected to contribute over **55%** of the total drywall volume, solidifying its position as the primary demand segment. The residential sector, while substantial in absolute terms, is not projected to contribute to overall market growth in the coming years.

4.5 Implications for the Drywall Industry

The differing growth rates and demand drivers across residential and non-residential segments carry significant implications for drywall manufacturers, suppliers, and contractors.

4.5.1 Strategic Focus and Investment